12 min read

Picture this: You’re standing on the balcony of your high-rise condo, gazing out at the skyline. The thought of selling it and moving into an HDB flat starts to creep into your mind. “Am I eligible for an HDB?”, “What are the extra fees?”, “How long will this take?”, “Where do I even start?!”

The overwhelming process of downgrading in 2024 looms like a dark cloud, and you feel lost, not knowing what steps to take first.

But don’t let the fear of the unknown paralyse you. This article breaks down exactly everything you need to know about downgrading. And what’s even better? We will show you how to maximise your profit while downgrading from a condo to a HDB.

There are 4 crucial steps to take note:

1. Checking Your Eligibility: Wondering if you can buy a HDB after selling your private property? We will help you figure out if you qualify, and explain exactly when you can make the move.

2. Planning Your Financials: Confused about your condo loan and CPF? We break it down for you, covering everything from Seller’s Stamp Duty (SSD) and Buyer’s Stamp Duty (BSD) to Additional Buyer’s Stamp Duty (ABSD) and the Resale Levy. Plus, find out how much loan you can get for your HDB and if you’re eligible for any grants.

3. Making Decisions: Not sure which HDB you can afford? We will guide you through the options and help you decide whether to sell your condo first or buy a HDB first.

4. Taking Action: Ready to take the plunge? Engage a property agent to market your condo for sale and gain the MAXIMUM profit on your property sale. Start viewing HDBs to find your perfect new home.

1. Checking Your Eligibility

Thinking of downgrading from a condo to an HDB? First, let’s see if you qualify and when you can make the move.

a. Can I buy a HDB after selling private property?

Apply for the HDB Flat Eligibility (HFE) letter from the Housing Development Board’s website. This form assesses your eligibility based on schemes, marital status, employment, citizenship, and income, including not owning another private residential property and not having sold one in the past 30 months. After submitting the HFE letter, you will be informed upfront of your eligibility to purchase a new or resale flat, as well as the amount of CPF housing grants and HDB housing loan you are eligible for.

Key points:

- You must not own another private property or have sold one in the last 30 months.

- HDB will check if you’re an essential occupier of an existing flat and if the Minimum Occupancy Period (MOP) is met.

- There’s a 15-month waiting period before you can buy a resale HDB flat but this doesn’t apply if you’re over 55 and looking to move to a 4-room resale flat or smaller.

Based on your details, the system gives a tailored recommendation.

For singles, you need to be at least 35 years old and a Singapore Citizen (SC) to buy a 2-room BTO or a larger resale flat. If you’re married, at least one spouse must be an SC or both must be Singapore Permanent Residents (SPR).

Refer to the table below for a quick overview:

| Citizenship Status of the Couple | New HDB Flat Eligibility | Resale HDB Flat Eligibility |

| SC – SC | Yes | Yes |

| SC – SPR | Yes | Yes |

| SC – FR | No | Yes |

| SPR – SPR | No | Yes |

| SPR – FR | No | No |

| FR – FR | No | No |

There are several other eligibility criteria such as income ceiling, ethnicity, ownership status of other private or foreign properties… the list goes on! It’s like navigating a maze, and you don’t want to get lost in the process.

For a custom analysis of your specific case, WhatsApp Kelvin Neo, top property agent in Singapore at 8118 3668. With his expert assistance, you will guarantee to own your HDB dream home smoothly!

b. Do I buy a New HDB Flat or Resale HDB Flat?

If you are qualified to buy both a new HDB flat and a resale flat, which one should you choose? When can you buy it?

Most people buy a resale flat due to its flexibility and availability.

Here’s a comparison:

| Buy New HDB Flat | Buy Resale HDB Flat |

| You can buy only after 30 months of selling your condo | Sell your condo within 6 months of purchase. Can buy anytime. |

| Might require you to rent during the waiting period | Able to control timelines to avoid renting |

| Balloting required for a new HDB flat. Have to sell at least 30 months before it’s ready. | Balloting not required |

| Limited selection | Islandwide availability |

| Easier to resell | Harder to resell |

2. Planning Your Financials

Before taking the leap from a condo to a HDB, there’s one crucial step you can’t afford to skip: planning your finances.

a. What Happens When I Sell My Condo?

When you sell your condo, you will need to pay off the existing loan. Two things to note on your loan: the notice period and lock-in period:

Notice Period:

- Typically, banks require a 3-month notice before early loan repayment.

- Providing less notice may incur a fee, varying from $3,000 to a percentage of the outstanding loan, depending on the bank.

Lock-in Period:

- During the initial years of your loan (usually 1-5 years), you’re locked into specific interest rates.

- Paying off the loan early during this period may lead to prepayment penalties, usually around 1.5% of the outstanding amount.

- Once the lock-in period ends, you can pay off the loan without penalties. However, terms may vary between banks, so always refer to your loan agreement for specifics.

b. Do I Get My CPF Back?

What happens to your CPF when you sell the condo?

When you sell your condo, you’ll need to “return” the CPF amount you withdrew for its purchase, along with interest. But here’s the twist: it’s still your money, and it can be reused for your HDB purchase. The interest rates? They vary, based on your account balance and age.

| Amount in Ordinary Account | Interest Rate (as of June 2022) |

| Up to $20,000 | 3.5% |

| Above $20,000 | 2.5% |

To view your accrued interest, you can log in to my CPF Online Services (under “My Statement”).

What happens to your CPF when you buy the HDB?

As of May 10, 2019, the government introduced new rules on how much CPF can be used for property purchases. Here are the key criteria:

- The property lease must allow the youngest owner to live there until at least age 95. If this condition isn’t met, the amount of CPF you can withdraw will be pro-rated.

- You can withdraw up to 100% of either the market value or the purchase price of the property from your CPF Ordinary Account (OA), whichever is lower.

c. Do I Need To Pay Seller’s Stamp Duty (SSD) When You Sell Your Condo?

Do you need to pay Seller’s Stamp Duty (SSD) when selling your condo? The answer hinges on the timing and duration of your property ownership journey.

If you’ve held your private property for a minimum of 3 years, you’re in the clear – no SSD required.

But how is SSD calculated? It’s based on the actual price or market value of your condo, whichever is higher.

| Date of Purchase or Date of Changeof Zoning / Use | Holding Period | SSD Rate |

| Before 14 Jan 2011 | – | No SSD payable |

| Between 14 Jan 2011 and 10 Mar 2017 (inclusive) | ≤ 1 year | 16% |

| 1 – 2 years | 12% | |

| 2 – 3 years | 8% | |

| 3 – 4 years | 4% | |

| > 4 years | No SSD payable | |

| After 10 Mar 2017 | ≤ 1 year | 12% |

| 1 – 2 years | 8% | |

| 2 – 3 years | 4% | |

| > 3 years | No SSD payable |

d. How much loan can I get for my HDB purchase?

Selling your condo before purchasing an HDB could be the key to unlocking a higher loan amount. Why? Because at the time of buying, you’d have zero properties under your name.

But if you buy first, your condo remains, making the HDB your second property. Banks will give a higher loan amount for those with fewer properties, offering more favourable loan terms. It’s a strategic move that could make all the difference in your home buying journey.

Here’s the bank loan rates below:

| Sell First (Own 0 properties at the time of buying) | Buy First (Already own 1 property at the time of buying) | |||

| Sum of Tenure and Age of Borrower | ≤ 65 Years | > 65 Years | ≤ 65 Years | > 65 Years |

| Loan-to-Value (LTV) | 75% | 55% | 45% | 25% |

| Cash Downpayment | 5% | 10% | 25% | 25% |

| CPF / Cash Downpayment | 20% | 35% | 30% | 50% |

Since July 6, 2018, banks have changed their Loan-to-Value (LTV) limits. The table above assumes you don’t own any other properties. But if you do, it’s important to check updated rates to see how they affect your loan eligibility.

e. Ever thought about getting a grant for your HDB?

HDB offers a variety of grants tailored for different situations – whether you’re a single, orphan, first-time HDB applicant, or a family looking to live near your loved ones. Each grant comes with its own set of eligibility criteria, so it’s worth checking out the details on HDB’s site.

And here’s the kicker: you can receive a maximum of two grants in your lifetime. So, don’t miss out on this opportunity to make your HDB dream a reality!

f. Do I need to pay Buyer’s Stamp Duty (BSD)?

Yes, when you buy your HDB, you’ll need to pay for a Buyer’s Stamp Duty (BSD). It’s calculated based on the purchase price or market value of your new home, whichever hits higher. Get all the details about Buyer’s Stamp Duty (BSD) right here.

| Purchase Price or Market Value of the Property | BSD Rates |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

g. Do I need to pay Additional Buyer’s Stamp Duty (ABSD)?

To curb the soaring home prices and ensure housing remains affordable, the government has raised the additional buyer’s stamp duty (ABSD) rates for locals, permanent residents, and foreigners alike.

Starting from December 16, 2021, the updated ABSD rates will come into effect for transactions where the Option to Purchase (OTP) is granted. However, first-time Singaporean and Singapore permanent resident homebuyers won’t feel the pinch, as their ABSD rates remain untouched at 0% and 5%, respectively.

For more details, check out the IRAS website.

h. Do I Need To Pay Resale Levy?

If you’ve previously bought a subsidised flat, you’ll need to pay a resale levy when buying another subsidised flat.

Subsidised housing includes:

- A flat purchased from HDB

- A resale flat purchased with CPF housing grant

- A Design Build and Sell Scheme (DBSS) flat purchased from property developer

- An Executive Condominium (EC) unit purchased from property developer

- Other subsidised housing forms (e.g. Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate etc.)

If you’re eyeing a resale flat or private property instead of a second subsidised HDB flat, here’s some good news: you won’t need to pay for the resale levy.

But don’t overlook the resale levy—it’s a crucial piece of the puzzle when planning your next HDB purchase. Dive more into the HDB Resale Levy details.

3. Making Decisions

Now that you have all these numbers, what’s next?

It’s time to figure out what you can actually afford and what you really need. Your available cash and CPF will play a big role in deciding if you can buy now or if you need to wait.

a. Which HDB Can I Afford?

Start by crunching the numbers to see how much you have for the purchase. Then, consider if you’ll need extra cash for things like renovations, other investments, or paying off debts.

| Potential Cash Proceeds = |

| Condo Sale Price – Outstanding Loan Amount – CPF Refund – Other Fees (Legal, Property Agent, Taxes, etc.) |

| Amount Available for Purchase = |

| Total CPF Balance Amount + Cash Proceeds + Loan + HDB Grant – Buyer’s Stamp Duty (BSD) – Additional Buyer’s Stamp Duty (ABSD) – Other financial commitments |

Here’s a glimpse of typical HDB prices:

- 3 Room HDB: ~ $290,000

- 4 Room HDB: ~ $400,000

- 5 Room HDB: ~ $480,000

- Executive Condominium: ~ $630,000

Keep in mind, these are average figures and actual prices may vary depending on factors like location and unit condition.

b. Should I Sell My Condo First or Purchase a HDB?

Your available funds are a major factor in the decision to sell or buy first. But there’s more to consider. Check out these pros and cons below—they’ll give you a clearer picture of which option suits you best:

| Selling Condo First | Buying HDB First |

| ✅ No Time Pressure: You have the flexibility to wait for a preferred selling price | ❌ Sale Time Limit: You have a 6-month time limit to sell your condo, which may create pressure to sell at a lower price. |

| ✅ Maximise Available Funds: The balance CPF from the condo sale can be used for the HDB purchase | ❌ Higher Funds Needed: You will need a higher CPF balance for the HDB purchase. |

| ✅ Higher Loan-to-Value (LTV) Ratio: Banks are likely to offer a higher LTV | ❌ Lower Loan-to-Value (LTV) Ratio: The LTV from the bank loan might be lower. |

| ✅ Lower Cash Downpayment: With more funds from the condo sale, you’ll need less cash upfront for the downpayment on your new property. | ❌ Higher Cash Downpayment: Require more out-of-pocket cash for the downpayment. |

| ❌ Temporary Housing: You might need to rent a house if your desired new home is not available immediately | ✅ Time to Choose: You can take your time selecting your preferred house |

| ❌ Quick Purchase Stress: There’s a potential stress of needing to buy a house quickly once the condo is sold | ✅ Leisurely Move-In: There’s no rush to move into your new home |

4. Taking Action

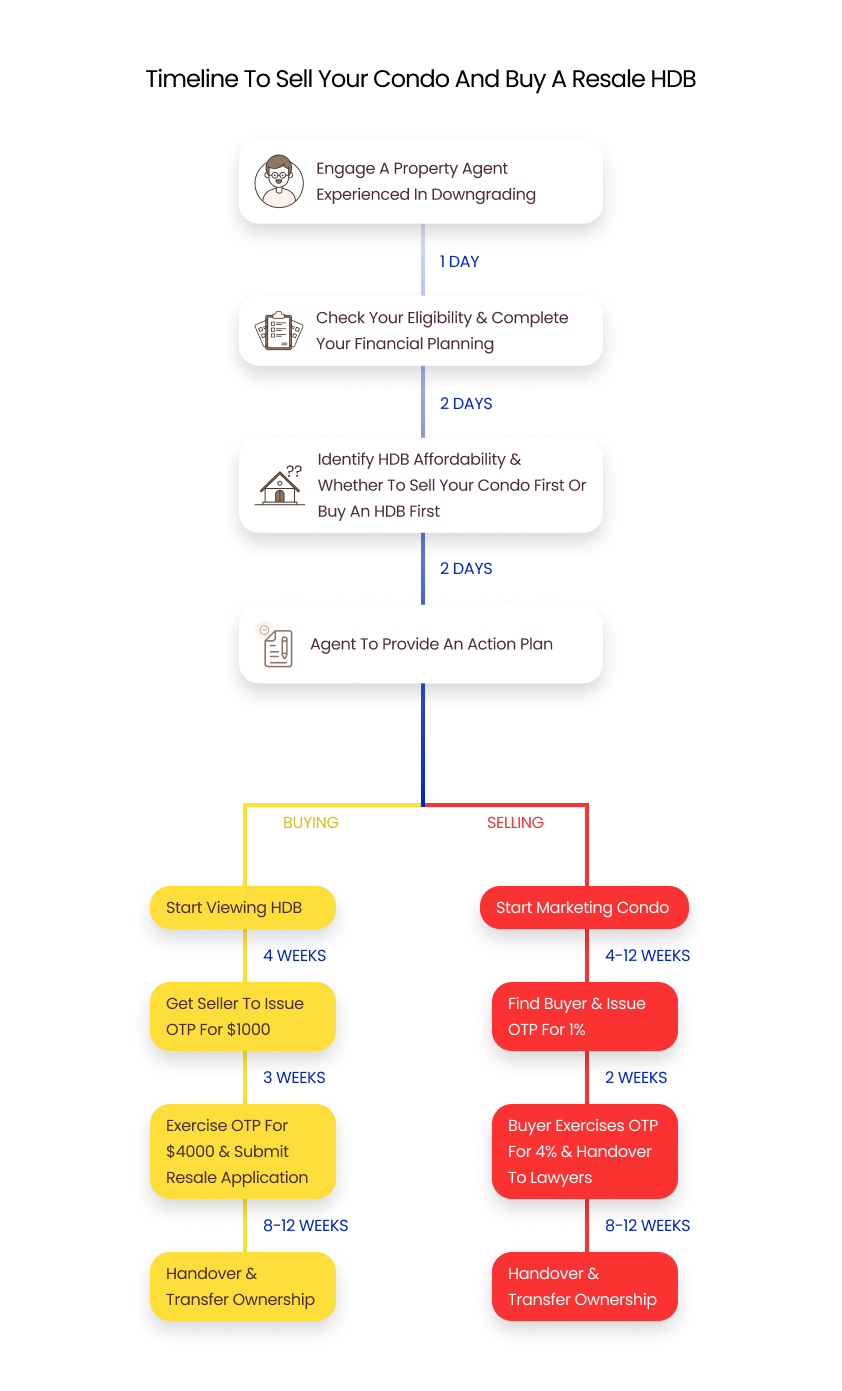

Whether you’re leaning towards buying the HDB first or selling the condo first, the timeline may unfold differently. But fear not, because the steps remain the same. Here are the key ones to keep in mind:

a. Engage a property agent

Your choice of property agent can make or break your journey towards selling your property and finding your dream home. With the constantly evolving regulations and tight timelines, you will need an expert who knows the ins and outs of the market.

Don’t waste time wondering – 3 FREE slots left to get Kelvin as your strategic partner! WhatsApp Kelvin Neo at 8118 3668.

He will help you with:

- Checking your eligibility

- Completing your financial planning

- Identify which HDB to buy

- Strategise the optimal timing for selling your condo first or buy an HDB first

And everything that comes after.

Kelvin Neo is the top property agent in Singapore that ensures your property stands out in the competitive market, attracting more buyers and securing the best deals. With Kelvin Neo’s 5-Star Marketing approach, you will sell your property at the HIGHEST profit. Don’t take our words for it, hear from his satisfied clients.

b. Start marketing your condo for sale

Selling a condo typically takes 3-6 months, although the timeline can vary based on factors such as unit condition, pricing strategy, and market demand. Key steps include finding buyers (which may take 4-12 weeks) and completing the ownership transfer process (which can take 8-12 weeks).

c. Start viewing HDBs to buy

Buying a resale HDB typically takes 2-3 months. Here’s what to expect:

- View, shortlist, and confirm your desired unit (allow 4 weeks)

- Hand over and transfer ownership (allocate 8-12 weeks)

- Optional: Dive into renovations (budget around 8 weeks)

Keep in mind: If your purchase speeds ahead of your sale and you need cash sooner, consider a bridging loan.

Check out the timeline infographic below to discover the specific steps involved in the purchase process and the duration of each step:

Conclusion

Downgrading from a condo to an HDB can be complex and filled with regulations, but following the steps in this article and having expert guidance from agents and lawyers can make it much smoother. What’s even better? Gain the HIGHEST profit when you sell your property.

Don’t waste time wondering – 3 FREE slots left to get Kelvin as your strategic partner!

What do you get?

- Sell your property QUICKLY

- Gain HIGHEST profit

- Sell smart across MULTIPLE channels

- Direct access to over 8,882 active BUYERS